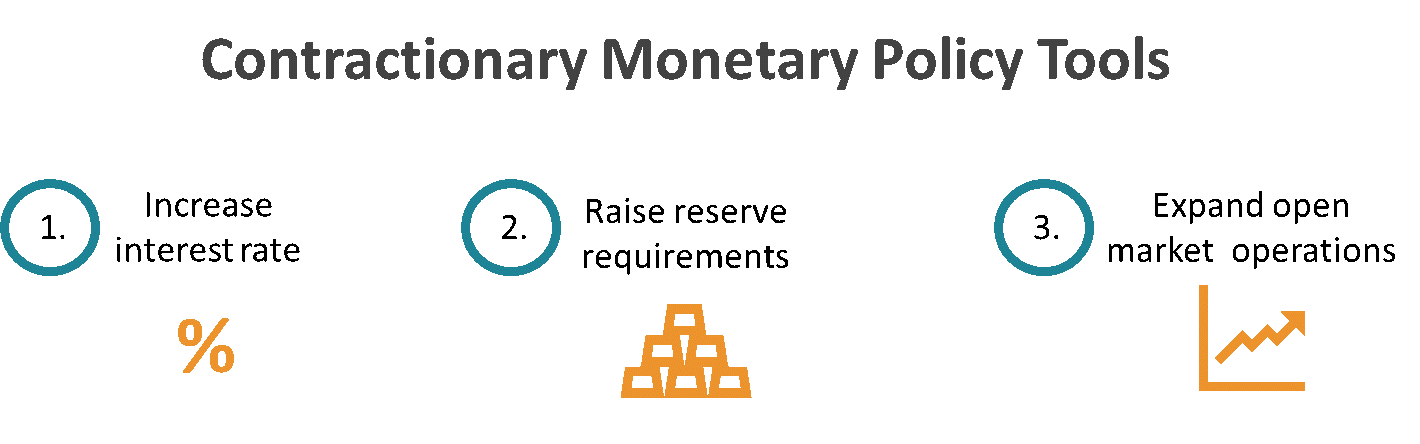

Monetary policy has two different facets. Monetary policy in this case is said to “tighten” or become more “contractionary” or “restrictive.” to offset or reverse economic downturns and bolster inflation, the fed can use its monetary policy tools to lower the federal funds rate.

Which Scenario Indicates That A Contractionary Monetary Policy Is Needed. This will eventually create economic growth. Monetary policy monetary policy monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy. Which scenario indicates an expansionary monetary policy is needed? The money supply has increased recently.

Which Scenario Indicates That A Contractionary Monetary Policy Is Needed? O A. Investment Has Been - Brainly.com From brainly.com

Which Scenario Indicates That A Contractionary Monetary Policy Is Needed? O A. Investment Has Been - Brainly.com From brainly.com

Related Post Which Scenario Indicates That A Contractionary Monetary Policy Is Needed? O A. Investment Has Been - Brainly.com :

The economy has grown too quickly. Monetary policy is then said to “ease” or become more “expansionary” or “accommodative.” It is a powerful tool to it is a powerful tool to inflation inflation inflation is an economic concept that refers to increases in the price level of goods over a set period of time. So, when the money supply increases, the contractionary monetary policy is needed to curbing the excess quantity of money.

Which scenario indicates a that contractionary monetary policy is needed.

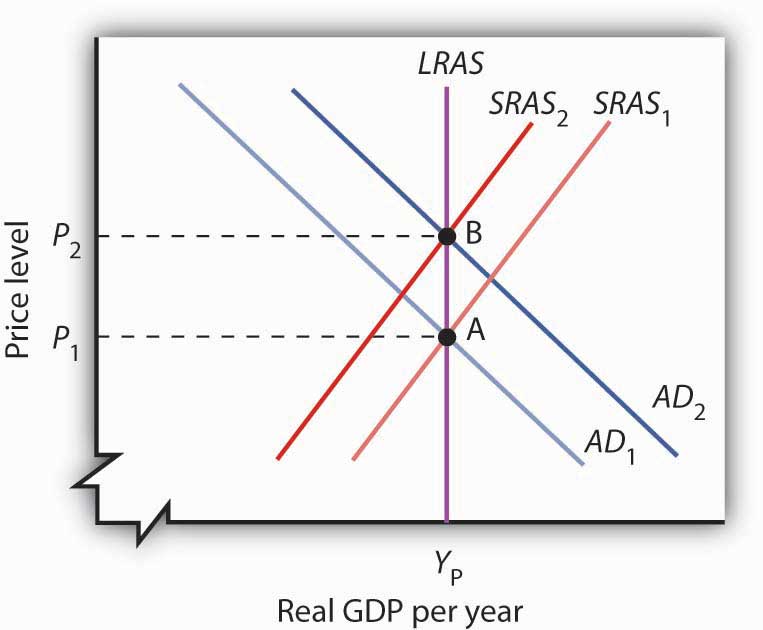

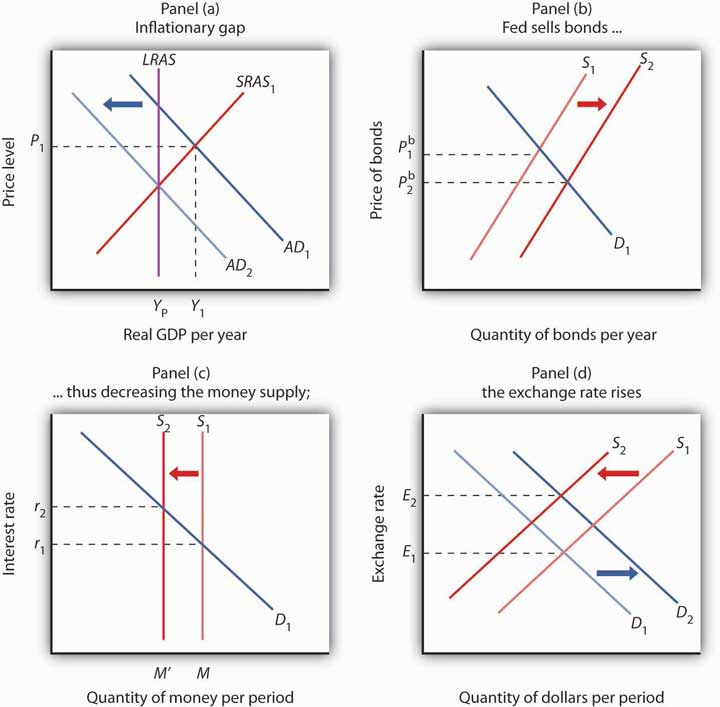

46 bond prices and interest rates A contractionary monetary policy, by driving up domestic interest rates, would cause the currency to appreciate. The contractionary monetary policy restricts the amount of money supply and controls the general price level in the economy. Academic work by leading macroeconomists portrays the central bank as highly capable of keeping economic activity stable because of its ability to monitor the Monetary policy in this case is said to “tighten” or become more “contractionary” or “restrictive.” to offset or reverse economic downturns and bolster inflation, the fed can use its monetary policy tools to lower the federal funds rate. This will eventually create economic growth.

Which scenario indicates that a contractionary monetary policy is needed? The effects will be the opposite of those described above for expansionary monetary policy. Higher interest rates lead to lower levels of capital investment.

This makes the lm curve to shift to the rightward direction. An expansionary monetary policy is needed to stimulate the economy. Ncontractionary monetary policy is a monetary policy that tends to raise interest rates and lower income.

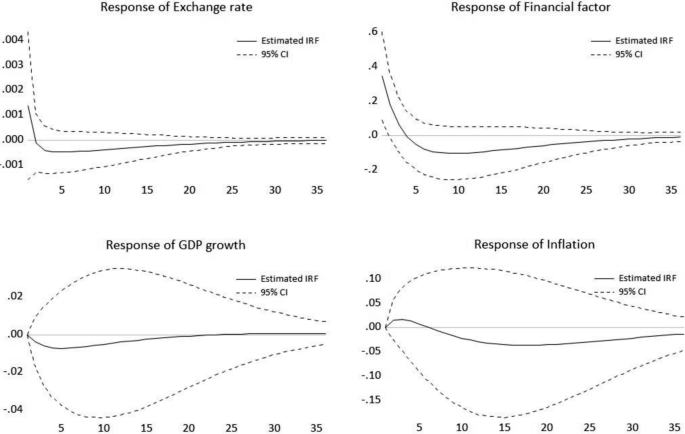

Source: researchgate.net

Source: researchgate.net

Contractionary policies are implemented during the expansionary phase of a business cycle to slow down economic growth. It is a powerful tool to it is a powerful tool to inflation inflation inflation is an economic concept that refers to increases in the price level of goods over a set period of time. When the central bank pursues contractionary monetary policy, we expect that this policy will result in an increase in the interest rate, a reduction in investment, a.

In an expansionary policy the supply of money in the economy is increased so that there is a boost in the economy. A contractionary monetary policy aims to slow down an economy that�s rising too fast, threatening a runaway jump in prices. When the central bank pursues contractionary monetary policy, we expect that this policy will result in an increase in the interest rate, a reduction in investment, a.

Source: researchgate.net

Source: researchgate.net

Which scenario indicates a that contractionary monetary policy is needed. Classify the actions described as examples of expansionary monetary policy (intended to stimulate the economy), contractionary or restrictive monetary policy (meant to slow down the economy), or not an example of monetary policy. This will eventually create economic growth.

Source: researchgate.net

Source: researchgate.net

On the other hand, a contractionary monetary policy aims at decreasing the level of money supply in the economy. Monetary policy has two different facets. Contractionary monetary policy corresponds to a decrease in the money supply or a fed sale of treasury bonds on the open bond market.

Source: open.lib.umn.edu

Source: open.lib.umn.edu

A contractionary monetary policy aims to slow down an economy that�s rising too fast, threatening a runaway jump in prices. 3.33, we have drawn negative sloping is curve and positive sloping lm curve. On the other hand, a contractionary monetary policy aims at decreasing the level of money supply in the economy.

The economy has been growing rapidly. On the other hand, a contractionary monetary policy aims at decreasing the level of money supply in the economy. Monetary policy attempts to stabilise the aggregate demand in the economy by regulating the money supply.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The economy has grown too quickly. There is either an expansionary or a contractionary monetary policy. 45 open market sale nin return for the bond, the bank of canada receives a cheque drawn against a bank.

Source: brainly.com

Source: brainly.com

This will eventually create economic growth. In an expansionary policy the supply of money in the economy is increased so that there is a boost in the economy. Which scenario indicates a that contractionary monetary policy is needed.

![Output Loss With A Non-Systematic Monetary Policy [Sims-Zha Scenario]… | Download Scientific Diagram Output Loss With A Non-Systematic Monetary Policy [Sims-Zha Scenario]… | Download Scientific Diagram](https://www.researchgate.net/profile/Muhammad-Zeshan-10/publication/332022227/figure/fig1/AS:741066911268864@1553695528216/Output-Loss-with-a-Non-systematic-Monetary-Policy-Sims-Zha-Scenario-5-lag-model.png) Source: researchgate.net

Source: researchgate.net

There is either an expansionary or a contractionary monetary policy. The higher value of the currency in foreign exchange markets would reduce exports, since from the perspective of foreign buyers, they are now more expensive. Which scenario indicates that a contractionary monetary policy is needed?

Source: quora.com

Source: quora.com

The economy has grown too quickly. This makes the lm curve to shift to the rightward direction. Which scenario indicates that a contractionary monetary policy is needed?

The higher value of the currency in foreign exchange markets would reduce exports, since from the perspective of foreign buyers, they are now more expensive. Contractionary monetary policy is a. Monetary policy monetary policy monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy.

The purpose of this method is to decrease the aggregate. In an expansionary policy the supply of money in the economy is increased so that there is a boost in the economy. Expansionary monetary policy is mainly used in a recession when demand for goods and services is low and people aren’t spending.

Source: oecd-ilibrary.org

Source: oecd-ilibrary.org

A seagull sits on top of a fence. The higher value of the currency in foreign exchange markets would reduce exports, since from the perspective of foreign buyers, they are now more expensive. The money supply has decreased recently.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

Academic work by leading macroeconomists portrays the central bank as highly capable of keeping economic activity stable because of its ability to monitor the The money supply has decreased recently. Academic work by leading macroeconomists portrays the central bank as highly capable of keeping economic activity stable because of its ability to monitor the

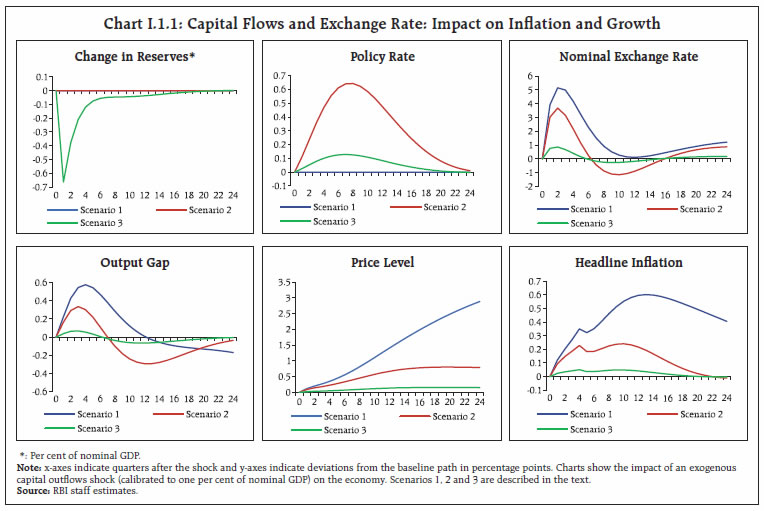

Source: rbi.org.in

Source: rbi.org.in

The money supply has decreased recently. 45 open market sale nin return for the bond, the bank of canada receives a cheque drawn against a bank. The economy is growing rapidly.

Source: study.com

Source: study.com

Classify the actions described as examples of expansionary monetary policy (intended to stimulate the economy), contractionary or restrictive monetary policy (meant to slow down the economy), or not an example of monetary policy. It is a powerful tool to it is a powerful tool to inflation inflation inflation is an economic concept that refers to increases in the price level of goods over a set period of time. Contractionary monetary policy is a.

Source: journalofeconomicstructures.springeropen.com

Source: journalofeconomicstructures.springeropen.com

Contractionary policies are implemented during the expansionary phase of a business cycle to slow down economic growth. Higher interest rates lead to lower levels of capital investment. The economy is growing rapidly.

Source: brainly.com

Source: brainly.com

Contractionary monetary policy is a. Expansionary monetary policy is mainly used in a recession when demand for goods and services is low and people aren’t spending. Interest rates will rise, the currency will appreciate, and this will close any inflationary gap that might exist.

Also Read :