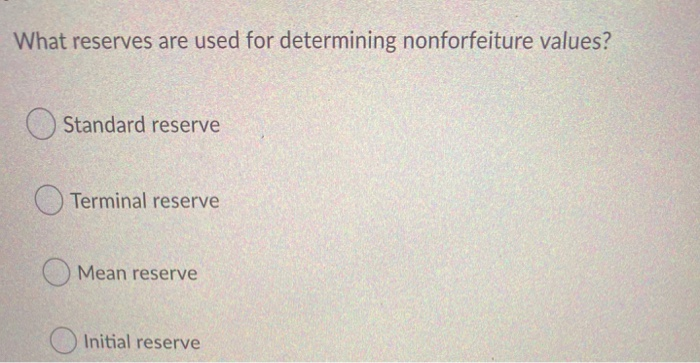

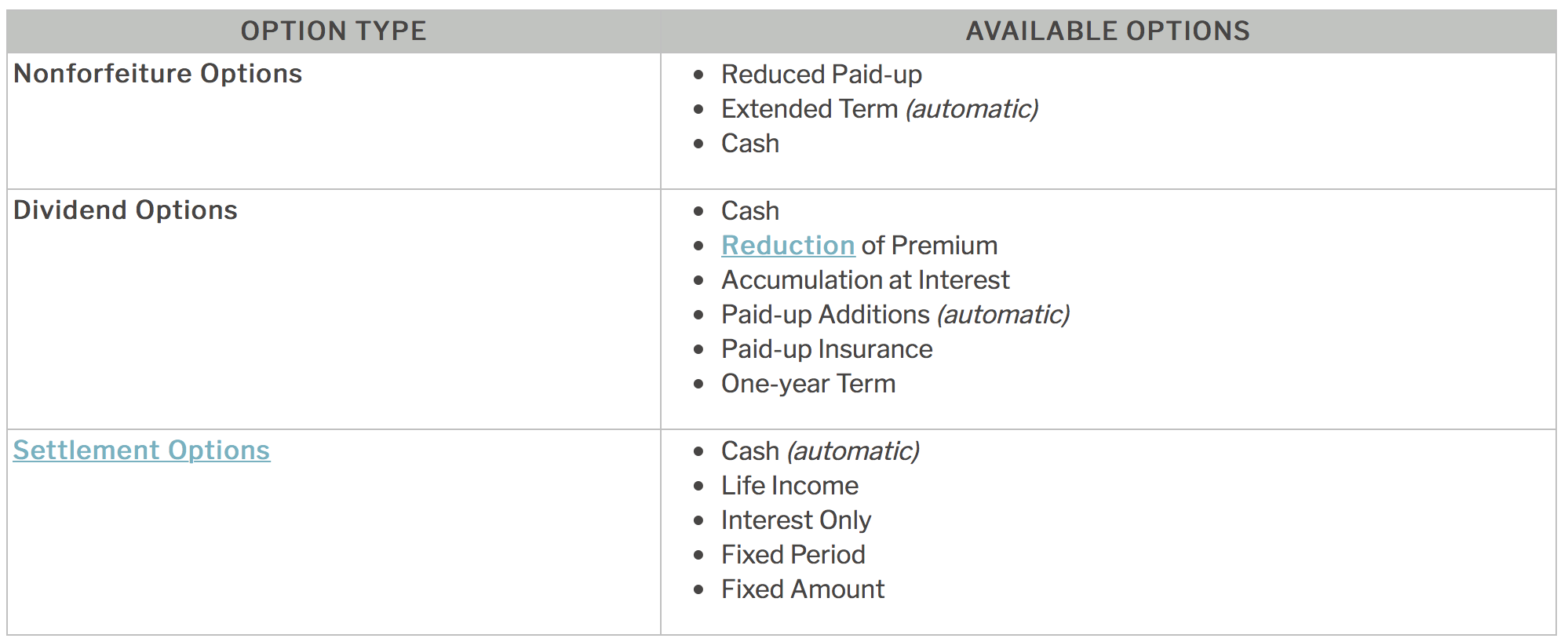

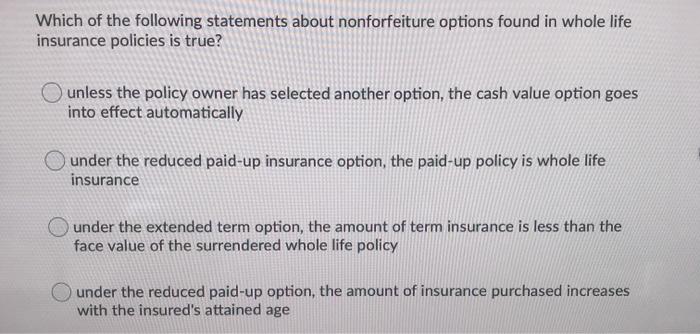

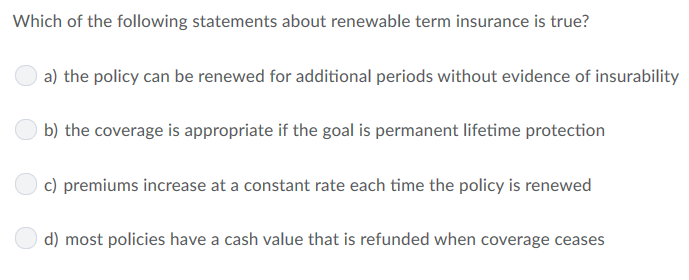

Nonforfeiture values — in whole life insurance policies, benefits that accrue to the insured when the policy lapses from nonpayment of premium. What is true nonforfeiture values?

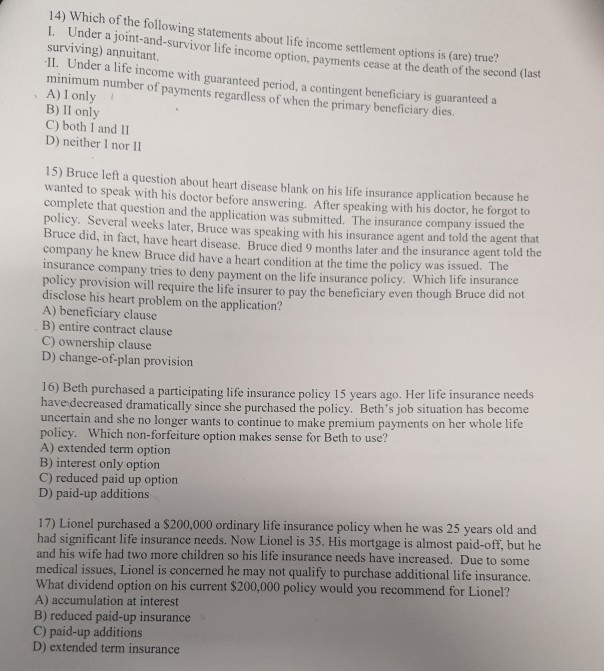

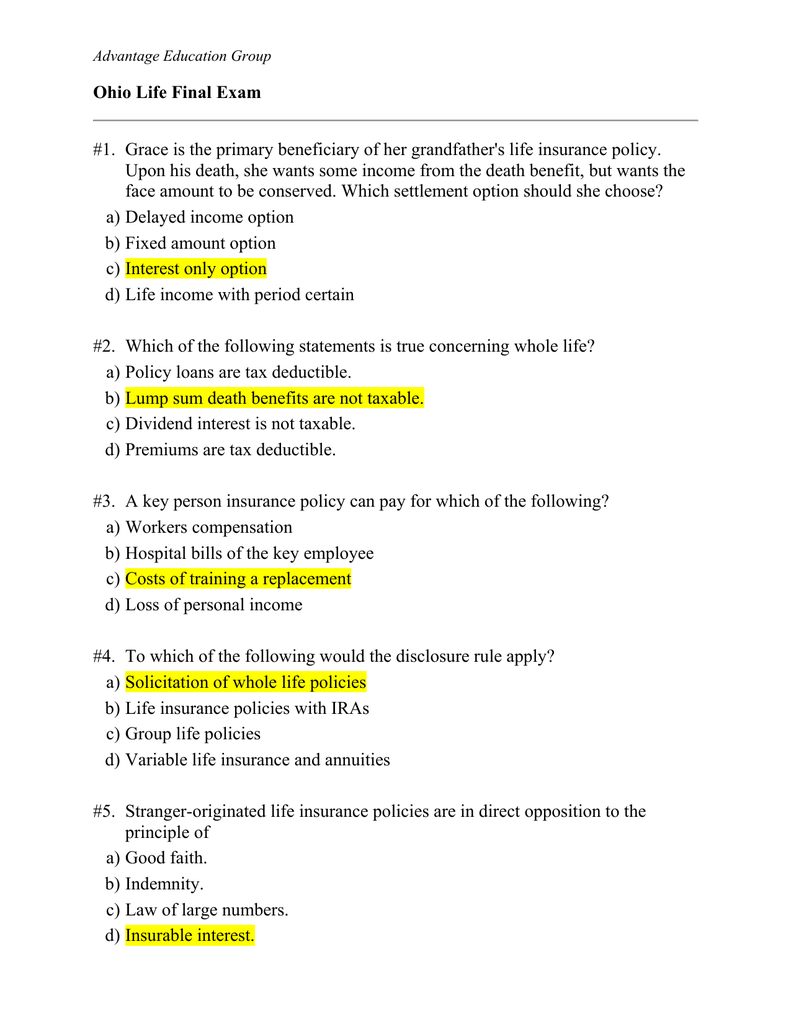

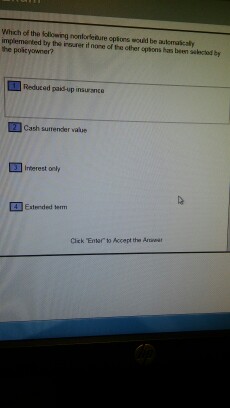

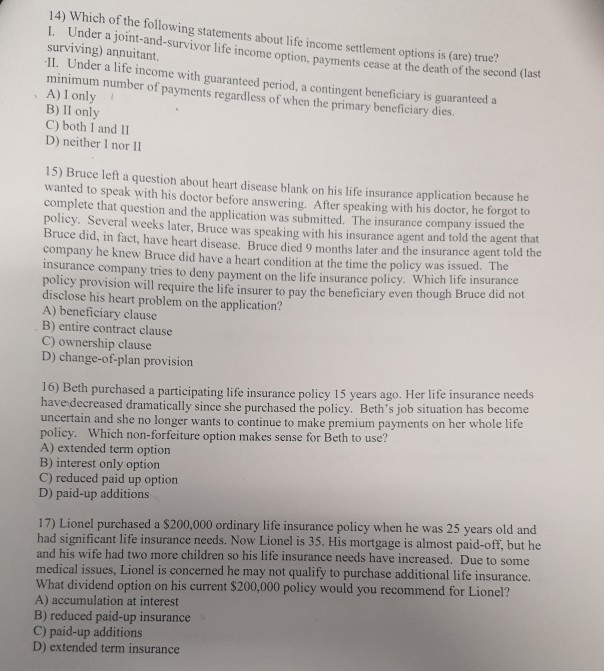

Which Of The Following Is True About Nonforfeiture Values. Upon the death of the insured, the primary beneficiary discovers that the insured chose the interest only settlement option. D) unless the policyowner has selected another nonforfeiture option, the cash value option goes into effect automatically. Which nonforfeiture option has the highest amount of insurance protection? Which of the following is true about nonforfeiture values?

Solved 14) Which Of The Following Statements About Life | Chegg.com From chegg.com

Solved 14) Which Of The Following Statements About Life | Chegg.com From chegg.com

Related Post Solved 14) Which Of The Following Statements About Life | Chegg.com :

A life insurance policy that develops, or has the potential to develop a cash value that does not contain the nonforfeiture options, cannot be delivered; Nonforfeiture values guarantee which of the following for the policyowner? What nonforfeiture option allows a policyowner to use the existing cash value to purchase a policy of the same face amount as the original policy but for a reduced amount of time? A) the policy has cash values and nonforfeiture values.

What is true nonforfeiture values?

Nonforfeiture values — in whole life insurance policies, benefits that accrue to the insured when the policy lapses from nonpayment of premium. Which of the following statements is true regarding the standard nonforfeiture law? Asked apr 26, 2021 in business by dcanes30. Nonforfeiture values guarantee which of the following for the policyowner? They are optional provisions 4. Which of the following best describes the nonforfeiture value of the annuity?

Source: chegg.com

Source: chegg.com

A) the policy may be paid up early by using accumulated cash values b) the policy may be paid up early by using policy dividends c) the policy’s premiums will increase after 20 years d) the policy’s cash values steadily decrease after 20 years A) the policy may be paid up early by using accumulated cash values b) the policy may be paid up early by using policy dividends c) the policy’s premiums will increase after 20 years d) the policy’s cash values steadily decrease after 20 years Authority to decide how to exercise nonforfeiture values.

A) they are required by state law to be included in the policy. The insured may use these options in one of three ways. Policyowners do not have the authority to decide how to exercise nonforfeiture values 2.

Source: chegg.com

Source: chegg.com

Nonforfeiture values give the insured the right to the cash value even if the policy lapses or is surrendered. Years day $45,000 7 whole life B) under the extended term option, the amount of term insurance is less than the face value of the surrendered cash value policy.

D policyowners do not have the. The insured may use these options in one of three ways. Authority to decide how to exercise nonforfeiture values.

Source: quizlet.com

Source: quizlet.com

The surrender value should be equal to 100% of the premium paid, minus any prior withdrawals and surrender charges. These options protect the insured�s cash value in the event that he/she decides to stop paying premiums. Which of the following best describes the nonforfeiture value of the annuity?

Source: studylib.net

Source: studylib.net

A life insurance policy that develops, or has the potential to develop a cash value that does not contain the nonforfeiture options, cannot be delivered; They are optional provisions 4. The surrender value will not be more than 80% of the cash value in the annuity at the time of surrender.

Which of the following is true about nonforfeiture values. Calculate the value of the nonforfeiture options for the following life insurance policy issued to a female at age 20. Which of the following is true about nonforfeiture values?

Source: studocu.com

Source: studocu.com

They are optional provisions 4. Which nonforfeiture option has the highest amount of insurance protection? A) the policy may be paid up early by using accumulated cash values b) the policy may be paid up early by using policy dividends c) the policy’s premiums will increase after 20 years d) the policy’s cash values steadily decrease after 20 years

A) that the death benefit will be paid in a lump sum b) that the policy premiums will never increase c) that the cash value will not be lost d) that the dividends will be paid annually because permanent life insurance policies have cash values, there are certain. All states have enacted nonforfeiture laws that require that whole life insurance policies specify the. The extended term nonforfeiture option has the same face amount as the original policy, but.

Source: docplayer.net

Source: docplayer.net

When a whole life policy lapses or is surrendered prior to maturity, the cash value can be used to. An insured receives an annual. D) policyowners do not have the authority to decide how to exercise nonforfeiture values.

Source: chegg.com

Source: chegg.com

Values for the next 10 years must be included in the policy. The extended term nonforfeiture option has the same face amount as the original policy, but. When a whole life policy lapses or is surrendered prior to maturity, the cash value can be used to.

Source: quizlet.com

Source: quizlet.com

Years day $45,000 7 whole life They are required by state law to be included in the policy 3. B) under the extended term option, the amount of term insurance is less than the face value of the surrendered cash value policy.

Source: yumpu.com

Source: yumpu.com

B) the policy generates immediate cash value. B) they are optional provisions. D) unless the policyowner has selected another nonforfeiture option, the cash value option goes into effect automatically.

What is true about nonforfeiture values? Nonforfeiture options/values are guarantees that are required by law to be part of life insurance policies that build cash value the correct answer is: Which of the following is true about nonforfeiture values.

What is true about nonforfeiture values? Which of the following best describes the nonforfeiture value of the annuity? What is true nonforfeiture values?

Source: chegg.com

Source: chegg.com

A) that the death benefit will be paid in a lump sum b) that the policy premiums will never increase c) that the cash value will not be lost d) that the dividends will be paid annually because permanent life insurance policies have cash values, there are certain. Values for the next 10 years must be included in the policy. Which of the following best describes the nonforfeiture value of the annuity?

Source: chegg.com

Source: chegg.com

Which nonforfeiture option has the highest amount of insurance protection? What is true nonforfeiture values? Policyowners do not have the authority to decide how to exercise nonforfeiture values 2.

Source: yumpu.com

Source: yumpu.com

Nonforfeiture values could result in the insured being paid the cash value of the policy and the policy being terminated. John, age 55, owns a whole life policy with a face amount of $100,000 for which the annual premium is $1,000. They are required by state law to be included in the policy 3.

Nonforfeiture values guarantee which of the following for the policyowner? Authority to decide how to exercise nonforfeiture values. A) that the death benefit will be paid in a lump sum b) that the policy premiums will never increase c) that the cash value will not be lost d) that the dividends will be paid annually because permanent life insurance policies have cash values, there are certain.

The surrender value will not be more than 80% of the cash value in the annuity at the time of surrender. The surrender value will not be more than 80% of the cash value in the annuity at the time of surrender. Table showing nonforfeiture values for the next 10 years must be included in the policy

Also Read :